Hello World#

%matplotlib inline

import pandas as pd

import cvxportfolio as cp

Download the problem data with yfinance. We select five liquid stocks.

import yfinance

tickers = ["AMZN", "AAPL", "MSFT", "GOOGL", "TSLA"]

# start_date = "2012-01-01"

# end_date = "2016-12-31"

returns = pd.DataFrame(

dict(

[

(

ticker,

yfinance.download(ticker)[ #, start_date=start_date, end_date=end_date)[

"Adj Close"

].pct_change(),

)

for ticker in tickers

]

)

)

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

returns.describe()

| AMZN | AAPL | MSFT | GOOGL | TSLA | |

|---|---|---|---|---|---|

| count | 6523.000000 | 10675.000000 | 9349.000000 | 4697.000000 | 3222.000000 |

| mean | 0.001704 | 0.001100 | 0.001134 | 0.000983 | 0.002125 |

| std | 0.036077 | 0.028212 | 0.021314 | 0.019434 | 0.036126 |

| min | -0.247661 | -0.518692 | -0.301159 | -0.116341 | -0.210628 |

| 25% | -0.013295 | -0.013056 | -0.009217 | -0.007995 | -0.015596 |

| 50% | 0.000402 | 0.000000 | 0.000352 | 0.000745 | 0.001218 |

| 75% | 0.014799 | 0.014695 | 0.011355 | 0.010087 | 0.019381 |

| max | 0.344714 | 0.332280 | 0.195652 | 0.199915 | 0.243951 |

We get the return on cash from FRED.

import pandas_datareader

returns[["USDOLLAR"]] = pandas_datareader.get_data_fred("DFF", start='2000-01-01') / (250 * 100)

returns = returns.fillna(method="ffill").dropna()

returns.tail()

| AMZN | AAPL | MSFT | GOOGL | TSLA | USDOLLAR | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2023-04-12 | -0.020917 | -0.004353 | 0.002334 | -0.006739 | -0.033460 | 0.000193 |

| 2023-04-13 | 0.046714 | 0.034104 | 0.022399 | 0.026663 | 0.029689 | 0.000193 |

| 2023-04-14 | 0.001074 | -0.002114 | -0.012766 | 0.013404 | -0.004841 | 0.000193 |

| 2023-04-17 | 0.002244 | 0.000121 | 0.009296 | -0.026637 | 0.011027 | 0.000193 |

| 2023-04-18 | -0.006619 | 0.004600 | -0.004778 | -0.008116 | -0.012992 | 0.000193 |

We compute rolling estimates of the first and second moments of the returns using a window of 1000 days. We shift them by one unit (so at every day we present the optimizer with only past data).

r_hat = returns.rolling(window=1000).mean().shift(1).dropna()

Sigma_hat = returns.shift(1).rolling(window=1000).cov().dropna()

r_hat

| AMZN | AAPL | MSFT | GOOGL | TSLA | USDOLLAR | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2014-06-20 | 0.001314 | 0.001108 | 0.000786 | 0.001036 | 0.002961 | 0.000005 |

| 2014-06-23 | 0.001300 | 0.001116 | 0.000803 | 0.001059 | 0.002971 | 0.000005 |

| 2014-06-24 | 0.001293 | 0.001127 | 0.000804 | 0.001085 | 0.003083 | 0.000005 |

| 2014-06-25 | 0.001300 | 0.001127 | 0.000794 | 0.001089 | 0.003189 | 0.000005 |

| 2014-06-26 | 0.001302 | 0.001121 | 0.000777 | 0.001113 | 0.003368 | 0.000005 |

| ... | ... | ... | ... | ... | ... | ... |

| 2023-04-12 | 0.000320 | 0.001412 | 0.001074 | 0.000738 | 0.003294 | 0.000048 |

| 2023-04-13 | 0.000280 | 0.001393 | 0.001063 | 0.000718 | 0.003256 | 0.000048 |

| 2023-04-14 | 0.000338 | 0.001429 | 0.001089 | 0.000753 | 0.003306 | 0.000049 |

| 2023-04-17 | 0.000339 | 0.001436 | 0.001043 | 0.000761 | 0.003343 | 0.000049 |

| 2023-04-18 | 0.000316 | 0.001441 | 0.001047 | 0.000726 | 0.003405 | 0.000049 |

2222 rows × 6 columns

Sigma_hat

| AMZN | AAPL | MSFT | GOOGL | TSLA | USDOLLAR | ||

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 2014-06-20 | AMZN | 4.237160e-04 | 1.014461e-04 | 9.996433e-05 | 1.531471e-04 | 2.003648e-04 | 9.720131e-10 |

| AAPL | 1.014461e-04 | 2.841137e-04 | 7.152255e-05 | 1.037271e-04 | 1.220260e-04 | -6.378275e-10 | |

| MSFT | 9.996433e-05 | 7.152255e-05 | 1.983346e-04 | 8.818659e-05 | 1.074351e-04 | -7.018987e-10 | |

| GOOGL | 1.531471e-04 | 1.037271e-04 | 8.818659e-05 | 2.528908e-04 | 1.364906e-04 | 2.541239e-10 | |

| TSLA | 2.003648e-04 | 1.220260e-04 | 1.074351e-04 | 1.364906e-04 | 1.424632e-03 | -6.411383e-10 | |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2023-04-18 | AAPL | 3.212597e-04 | 4.669670e-04 | 3.427499e-04 | 3.168139e-04 | 4.707923e-04 | -1.459881e-08 |

| MSFT | 3.287896e-04 | 3.427499e-04 | 4.118900e-04 | 3.408980e-04 | 4.190421e-04 | 1.773549e-09 | |

| GOOGL | 3.220580e-04 | 3.168139e-04 | 3.408980e-04 | 4.396580e-04 | 3.835795e-04 | -2.223956e-08 | |

| TSLA | 4.559975e-04 | 4.707923e-04 | 4.190421e-04 | 3.835795e-04 | 1.848895e-03 | -1.065242e-07 | |

| USDOLLAR | -2.047893e-08 | -1.459881e-08 | 1.773549e-09 | -2.223956e-08 | -1.065242e-07 | 3.357492e-09 |

13332 rows × 6 columns

For the cash return instead we simply use the previous day’s return.

r_hat['USDOLLAR'] = returns['USDOLLAR'].shift(1)

Here we define the transaction cost and holding cost model (sections 2.3 and 2.4 of the paper). The data can be expressed as

a scalar (like we’re doing here), the same value for all assets and all time periods;

a Pandas Series indexed by the asset names, for asset-specific values;

a Pandas DataFrame indexed by timestamps with asset names as columns, for values that vary by asset and in time.

tcost_model = cp.TcostModel(half_spread=10e-4)

hcost_model = cp.HcostModel(borrow_costs=1e-4)

We define the single period optimization policy (section 4 of the paper).

risk_model = cp.FullCovariance(Sigma_hat)

gamma_risk, gamma_trade, gamma_hold = 1.0, 1.0, 1.0

leverage_limit = cp.LeverageLimit(3)

spo_policy = cp.SinglePeriodOpt(

return_forecast=r_hat,

costs=[

gamma_risk * risk_model,

gamma_trade * tcost_model,

gamma_hold * hcost_model,

],

constraints=[leverage_limit],

)

We run a backtest, which returns a result object. By calling its summary method we get some basic statistics.

market_sim = cp.MarketSimulator(

returns, [tcost_model, hcost_model], cash_key="USDOLLAR"

)

init_portfolio = pd.Series(index=returns.columns, data=250000.0)

init_portfolio.USDOLLAR = 0

results = market_sim.run_multiple_backtest(

init_portfolio,

start_time="2020-01-01",

end_time="2023-04-01",

policies=[spo_policy,

cp.Hold()

],

)

results[0].summary()

---------------------------------------------------------------------------

RemoteTraceback Traceback (most recent call last)

RemoteTraceback:

"""

Traceback (most recent call last):

File "/opt/hostedtoolcache/Python/3.10.11/x64/lib/python3.10/site-packages/multiprocess/pool.py", line 125, in worker

result = (True, func(*args, **kwds))

File "/opt/hostedtoolcache/Python/3.10.11/x64/lib/python3.10/site-packages/multiprocess/pool.py", line 48, in mapstar

return list(map(*args))

File "/home/runner/work/cvxportfolio/cvxportfolio/cvxportfolio/simulator.py", line 272, in _run_backtest

return self.run_backtest(

File "/home/runner/work/cvxportfolio/cvxportfolio/cvxportfolio/simulator.py", line 231, in run_backtest

u = policy.get_trades(h, t)

File "/home/runner/work/cvxportfolio/cvxportfolio/cvxportfolio/policies.py", line 493, in get_trades

constraints += constr.weight_expr(t, wplus, z, value)

File "/home/runner/work/cvxportfolio/cvxportfolio/cvxportfolio/constraints.py", line 47, in weight_expr

result = self.compile_to_cvxpy(wplus, z, v)

NameError: name 'wplus' is not defined

"""

The above exception was the direct cause of the following exception:

NameError Traceback (most recent call last)

Cell In[10], line 6

4 init_portfolio = pd.Series(index=returns.columns, data=250000.0)

5 init_portfolio.USDOLLAR = 0

----> 6 results = market_sim.run_multiple_backtest(

7 init_portfolio,

8 start_time="2020-01-01",

9 end_time="2023-04-01",

10 policies=[spo_policy,

11 cp.Hold()

12 ],

13 )

14 results[0].summary()

File ~/work/cvxportfolio/cvxportfolio/cvxportfolio/simulator.py:279, in MarketSimulator.run_multiple_backtest(self, initial_portf, start_time, end_time, policies, loglevel, parallel)

277 if parallel:

278 workers = multiprocess.Pool(num_workers)

--> 279 results = workers.map(_run_backtest, policies)

280 workers.close()

281 return results

File /opt/hostedtoolcache/Python/3.10.11/x64/lib/python3.10/site-packages/multiprocess/pool.py:367, in Pool.map(self, func, iterable, chunksize)

362 def map(self, func, iterable, chunksize=None):

363 '''

364 Apply `func` to each element in `iterable`, collecting the results

365 in a list that is returned.

366 '''

--> 367 return self._map_async(func, iterable, mapstar, chunksize).get()

File /opt/hostedtoolcache/Python/3.10.11/x64/lib/python3.10/site-packages/multiprocess/pool.py:774, in ApplyResult.get(self, timeout)

772 return self._value

773 else:

--> 774 raise self._value

NameError: name 'wplus' is not defined

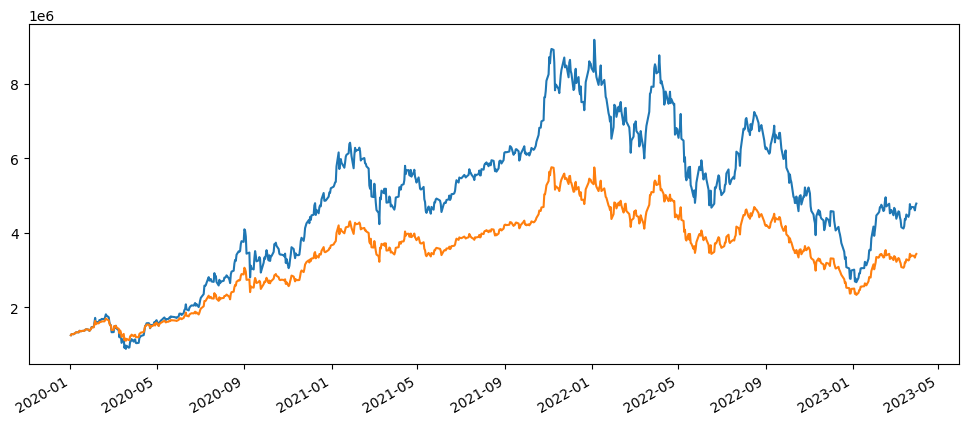

The total value of the portfolio in time.

results[1].summary()

Number of periods 818

Initial timestamp 2020-01-02 00:00:00

Final timestamp 2023-03-31 00:00:00

Portfolio return (%) 41.343

Excess return (%) 40.340

Excess risk (%) 45.013

Sharpe ratio 0.897

Max. drawdown 59.516

Turnover (%) 0.000

Average policy time (sec) 0.000

Average simulator time (sec) 0.001

results[0].v.plot(figsize=(12, 5))

results[1].v.plot(figsize=(12, 5))

<Axes: >

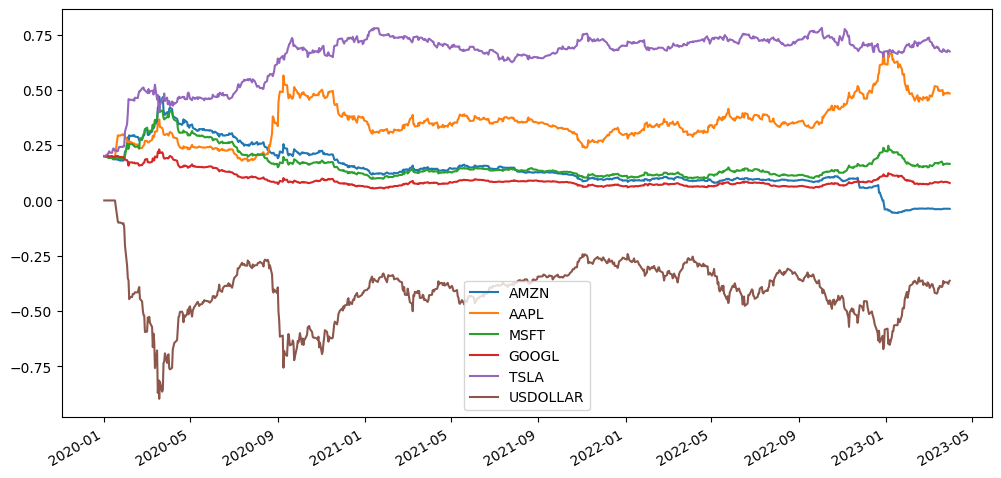

The weights vector of the portfolio in time.

results[0].w.plot(figsize=(12, 6))

<Axes: >